GOODS and services tax (GST) is the tax that everyone is talking

about but is probably the most misunderstood tax in this current

economic climate. The deferment of GST caused ripples in the current

climate. Where does GST go from here? Has the tax been shelved or will

GST be implemented in the next two years? Will the consumer ever get to

see “inclusive of GST” on a price tag in Malaysia? Is this another

setback for GST?

Statements that begin as questions and are replied with more

questions – are the taxpayers ready for a replacement consumption tax?

Is the rakyat aware of the GST mechanism and its implications? Is

it a fairer and more transparent tax system compared with the existing

sales and service tax regime?

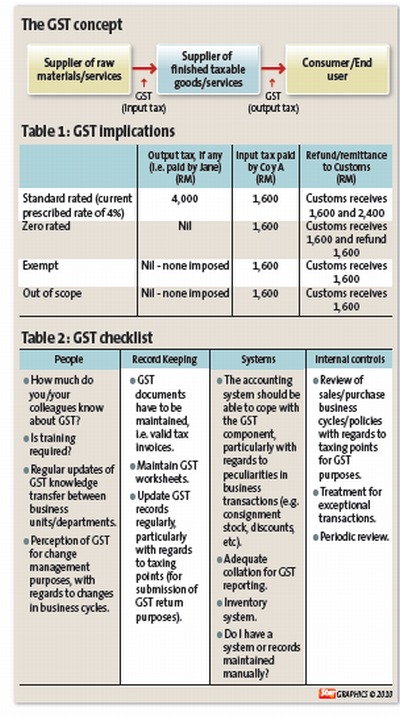

Going back to the basics, GST is a broad based consumption tax that will replace the existing sales and service taxes (see chart).

The concept of GST allows a self-policing mechanism for collection of

taxes, which should result in lower leakages and a lowering of other

direct taxes in the future. It is a transaction-based tax, which

requires regular submission of both tax returns and remittances of the

taxes collected. Such a mechanism allows for refunds to be issued in a

more efficient manner, as the monies due to taxpayers (when the output

taxes paid are lower than the input taxes paid) are already in the

coffers of the Royal Malaysian Customs, due to the regular remittances

made by GST registered entities.

Goods and services are either subject to GST (taxable) or not (non

taxable). For taxable goods and services, there are two rates of GST

that can be imposed, i.e. standard rate (current prescribed rate to be

imposed is 4%) and zero rate. For non-taxable goods and services, there

are two categories to be considered, i.e. exempt and ‘out of scope’. In

both categories of non-taxable goods and services, no GST (i.e. output

tax) is imposed and no GST (i.e. input tax) can be claimed.

GST in action

In order to illustrate the different GST implications based on the

various categories, we have used arbitrary figures in the example below.

Company A manufactures, develops and sells finished products to

consumers. GST considerations have to be made with regards to the

supplies/raw materials acquired to manufacture/develop (value-added

activity), together with the GST (if any) to be imposed on the selling

price to the customer.

Jane acquires a finished product of RM100,000 and Company A acquires

supplies/raw materials (taxable supplies) for RM40,000 and pays its

suppliers, RM41,600 (GST component – input tax of RM1,600).

We have outlined the GST implications based on the different categories in Table 1.

Is the rakyat aware of the GST mechanism and its implications? Are they ready?

Further to the Second Finance Minister’s statement (March 13, 2010)

in respect of the deferment of the reading of the draft GST bill, a

point to note is the concern of the “readiness” of the rakyat of this new tax. How many people actually understand the mechanism and impact of GST?

GST is a transparent tax, where there is no cascading effect akin to

what is currently experienced with the existing sales and service tax

(‘hidden taxes’ borne by the consumer). However, due to lack of

awareness and understanding of the GST mechanism, implementation of such

a tax could present some challenges.

Does it really take 12 to 18 months for a business entity to get

ready to be able to cope in a GST environment? Generally, the time

required for a GST implementation exercise varies from business entity

to entity, with regards to the existing infrastructure, volume of

business transactions, peculiarities of the business itself as well as

how efficient the GST knowledge transfer is executed.

A bird eye’s view of considerations to be made with regards to how ready you are for GST is outlined in Table 2. Even though GST is a tax, it impacts all operations of a business.

The list of considerations outlined in Table 2 is not

exhaustive. Please note that the “GST readiness” for each entity would

vary based on type of business, GST awareness, infrastructure, etc. We

hope that the above checklist can provide some assistance to businesses,

in terms of determining how ready they may or may not be for a GST

environment.

The extension of time or rather deferment of GST can be viewed as

being practical, in terms of enabling more taxpayers to educate and

better prepare themselves for the impending GST environment. A smooth

transition into a new climate is possible, provided steps are taken

based on the requirements of an entity (i.e. depending on how “GST

ready” they are). Therefore, taking measures to take stock of your

position in relation to GST, should be taken now to enable planning for

the implementation exercise.

“To think too long about doing a thing often becomes its undoing”.

The introduction of GST as a replacement tax and its deferred reading at

parliament, really allows more time for the rakyat to get ready.

However, the clock starts ticking now and the additional time only

becomes useful, if actions are taken now to determine the timelines and

implementation exercise to be executed.